How to Budget for the Things You Can’t Predict

Budgeting isn’t just about monthly bills. Learn how insurance helps you plan for unpredictable expenses and reduce financial disruption.

January is budgeting season. People are tracking spending, setting goals, and trying to make their money work a little harder this year.

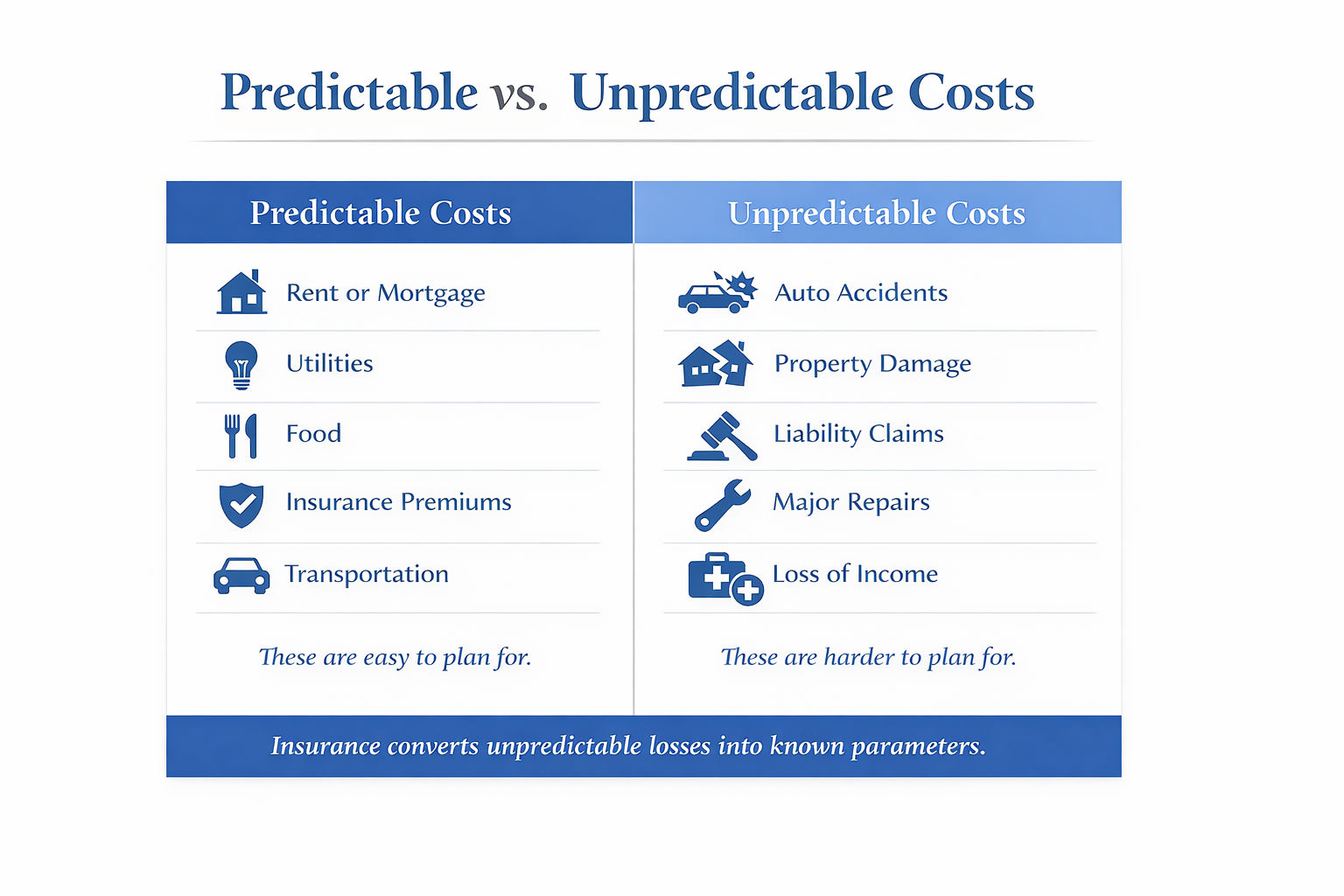

Most budgets focus on what’s predictable: housing, groceries, utilities, subscriptions. That’s a solid place to start. But financial stress rarely comes from predictable expenses. It usually comes from disruption. Things like accidents, damage, lawsuits, or unexpected loss of income.

This is where insurance fits into budgeting in a way that often gets overlooked.

Insurance doesn’t prevent these events from happening. It defines the financial boundaries when they do.

Budgeting Isn’t Just About Monthly Expenses

Traditional budgeting answers one question:

“What do I expect to spend?”

Financial planning answers a second, equally important question:

“What could financially disrupt me?”

Without accounting for disruption, even a well-organized budget can unravel quickly. One unexpected event can undo months or years of careful planning.

Insurance exists to reduce volatility. Not by eliminating risk, but by making its financial impact predictable.

The Three Numbers That Matter in Insurance Planning

When insurance supports a budget well, three numbers are aligned:

1. Premium

This is the predictable cost — the part that belongs in your monthly budget.

2. Deductible

This is the portion you agree to cover yourself before insurance applies. Think of it as intentional self-insurance.

3. Coverage Limits

These define your financial ceiling if something serious happens.

If these numbers don’t align with your savings and risk tolerance, insurance can become a source of stress instead of support.

Why Emergency Funds Alone Aren’t Enough

Emergency savings are important. They’re not a replacement for insurance.

Savings are best used for:

● Short-term disruptions

● Known expenses

● Temporary income gaps

Insurance is designed for:

● Large losses

● Legal liability

● Events that exceed what most households could comfortably absorb

A strong financial plan uses both.

Budgeting for Peace of Mind

When insurance is properly aligned with your budget, it creates clarity:

● You know your worst-case financial exposure

● You understand what is and isn’t covered

● You’re less likely to panic during stressful events

This isn’t about buying more insurance. It’s about having the right structure in place.

January Is a Natural Time to Review

Life changes quietly over time. Budgets and coverage should keep pace.

January is often the best time to review:

● Deductibles vs. savings

● Coverage limits

● Changes in assets or income

● New risks that weren’t there before

A review doesn’t require making changes. It simply brings accuracy.

Budgeting isn’t just about discipline — it’s about preparation.

Insurance plays a quiet but critical role in making financial plans resilient, not just organized.